Dream11 parent launches Dream Money app. This marks a bold step into fintech at a time when the company is facing challenges due to India’s strict online gaming regulations. Dream Sports is making a clever shift by moving from fantasy sports to financial services, proving they can quickly adapt to the evolving market.

India’s 28% GST on online gaming disrupted the fantasy sports industry. Dream11, a major player in the industry, had to put a halt to its real-money contests, which significantly affected its revenue. Instead of waiting for things to stabilize, Dream Sports decided to explore fresh opportunities. This led to the creation of Dream Money, a financial services app designed to make investing simple and affordable.

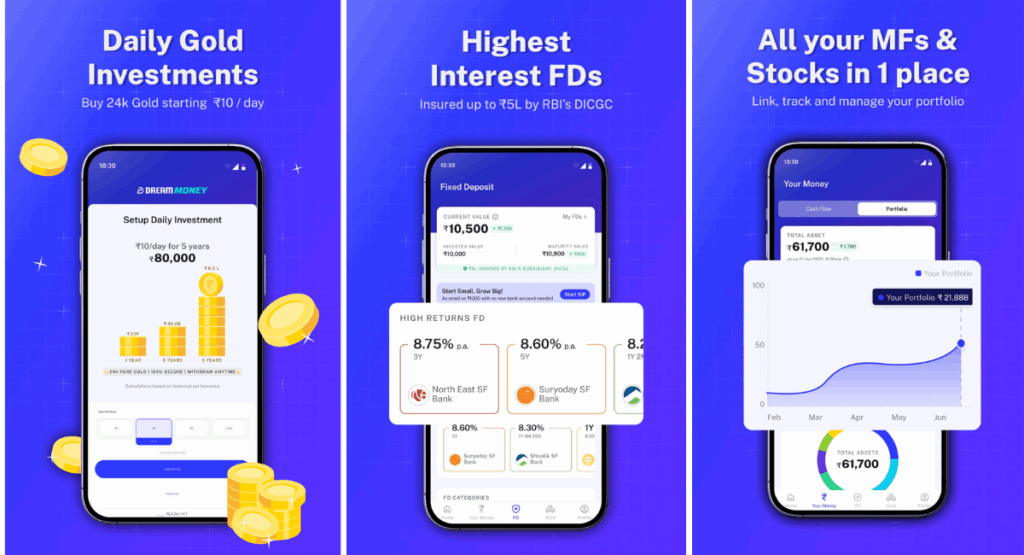

The app allows users to:

- Invest in digital gold starting at just ₹10 per day.

- Open fixed deposits with a minimum of ₹1,000.

These small entry points make the platform attractive to first-time investors. The app is being built under DreamSuite Platform Pvt. Ltd., part of a broader initiative called DreamSuite Finance, which could expand into SIPs, insurance, and more. Currently, Dream Money is in its pilot phase and already listed on the Google Play Store. The listing highlights gold investments and fixed deposits as its core features.

This is not Dream Sports’ first fintech experiment. In 2023, they rolled out DreamX, a UPI payments app. However, the project shut down after the Reserve Bank of India’s restrictions on co-branded UPI apps.

Dream Money, however, has a stronger foundation. It is supported by partnerships with small finance banks and regulated fintech companies. Additionally, this guarantees that users have access to safer and more trustworthy investment choices.

Dream Sports already manages a diverse portfolio, including:

- FanCode – a sports streaming platform.

- Dream Set Go – a sports travel service.

- Dream Game Studios – a gaming development venture.

Further, adding fintech through Dream Money shows the company’s determination to diversify revenue streams and reduce dependence on fantasy sports. Dream Money focuses on micro-investments, making wealth creation accessible to everyone. Students, young professionals, and middle-class families can now begin saving with minimal amounts.

This strategy is also a way to retain Dream11’s existing user base. Earlier, fans engaged with cricket contests. Now, they can use the same brand to start their financial journey. It’s a smart way to keep the brand alive in people’s daily lives.

Moreover, the launch of Dream Money is more than just a product launch; it’s a survival strategy. Dream Sports is transforming itself from a gaming leader into a fintech player. If successful, this move could reshape its future and influence how other gaming companies approach diversification. In the end, the Dream11 parent company launches the Dream Money app, making it a bold shift from cricket fields to financial freedom.